Discover current challenges and probable solutions of automating mutual fund investments through design driven technology

The mutual fund industry has witnessed a momentous growth trajectory in the last decade; growing at the rate of over 400% in the last 10 years. More so, the mobile trading platform launched in 2010 is now the fastest growing in the world.

However, these astonishing feats were accomplished on a consumer base of about 0.3% of the entire population.

Online broking platforms must leverage sophisticated UX and UI capabilities to extend this user base through financial literacy and enable the masses to partake in the capital value creation through mutual funds.

As a culture, India has a precarious relationship with money. Deeply ingrained societal values dictate that we work hard to earn money and save consciously to secure a better future for our family.

Investment instruments like physical gold and community-based chit funds that encompass a majority of the population till date are being considered secondary at least in metropolitan cities.

Its place has been taken by stock trading platforms that allow people to partake in the wealth creation in the capital markets. We here take a close look at the Mutual Funds (MFs) market.

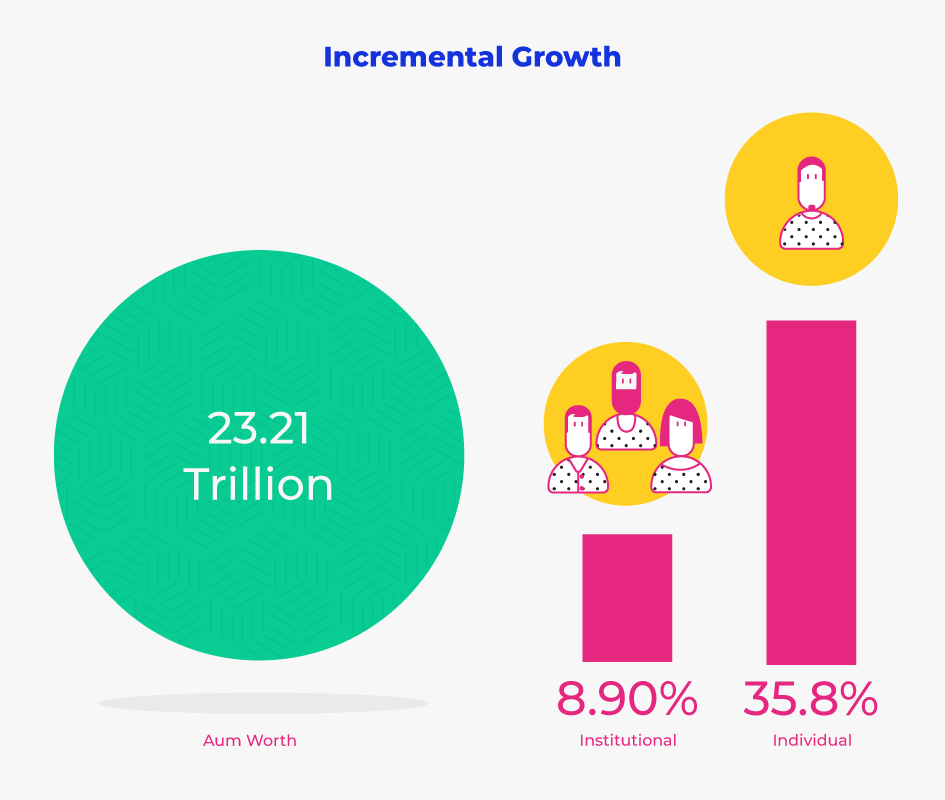

The Indian Mutual Fund Industry has grown by leaps and bounds to become the fastest growing segment of our financial sector.

The value of assets held by individual investors showcase an absolute increase of 35.8% wherein the Institutional assets increased at an absolute growth of 8.90%.

Its place has been taken by stock trading platforms that allow people to partake in the wealth creation in the capital markets. We here take a close look at the Mutual Funds (MFs) market.

The Indian Mutual Fund Industry has grown by leaps and bounds to become the fastest growing segment of our financial sector.

The value of assets held by individual investors showcase an absolute increase of 35.8% wherein the Institutional assets increased at an absolute growth of 8.90%.

Data shows that in the first eight months of 2015-16, some 35 lakh new investors put their money in mutual funds through the SIP route, signaling a major shift in the investment mindset of the nation.

Systematic investment plans (SIPs) have now become synonymous with MFs. For most salaried professional who take home a monthly salary, a monthly SIP that automates the investment process fits well with their cash flows.

The disciplined design of an SIP allows for the allocation of regular investments in a majority of equity-backed mutual funds, which helps investors make the most of the volatile nature of capital markets.

Industry data shows that the mutual fund sector added 19 lakh Systematic Investment Plan (SIP) accounts in the first nine months of 2015-16.

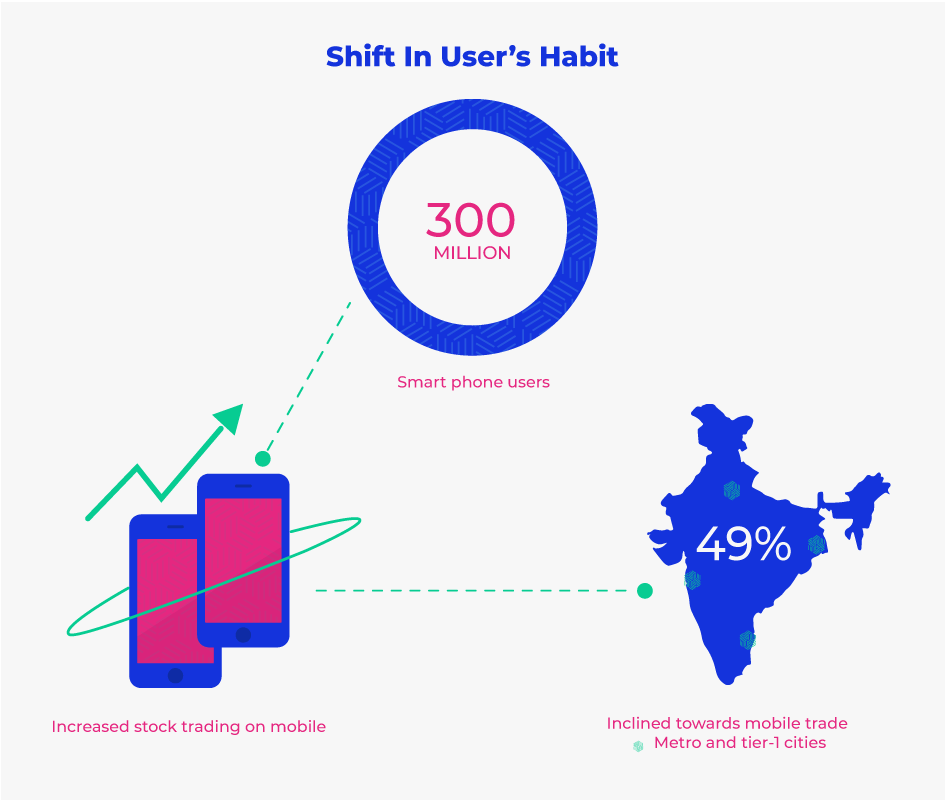

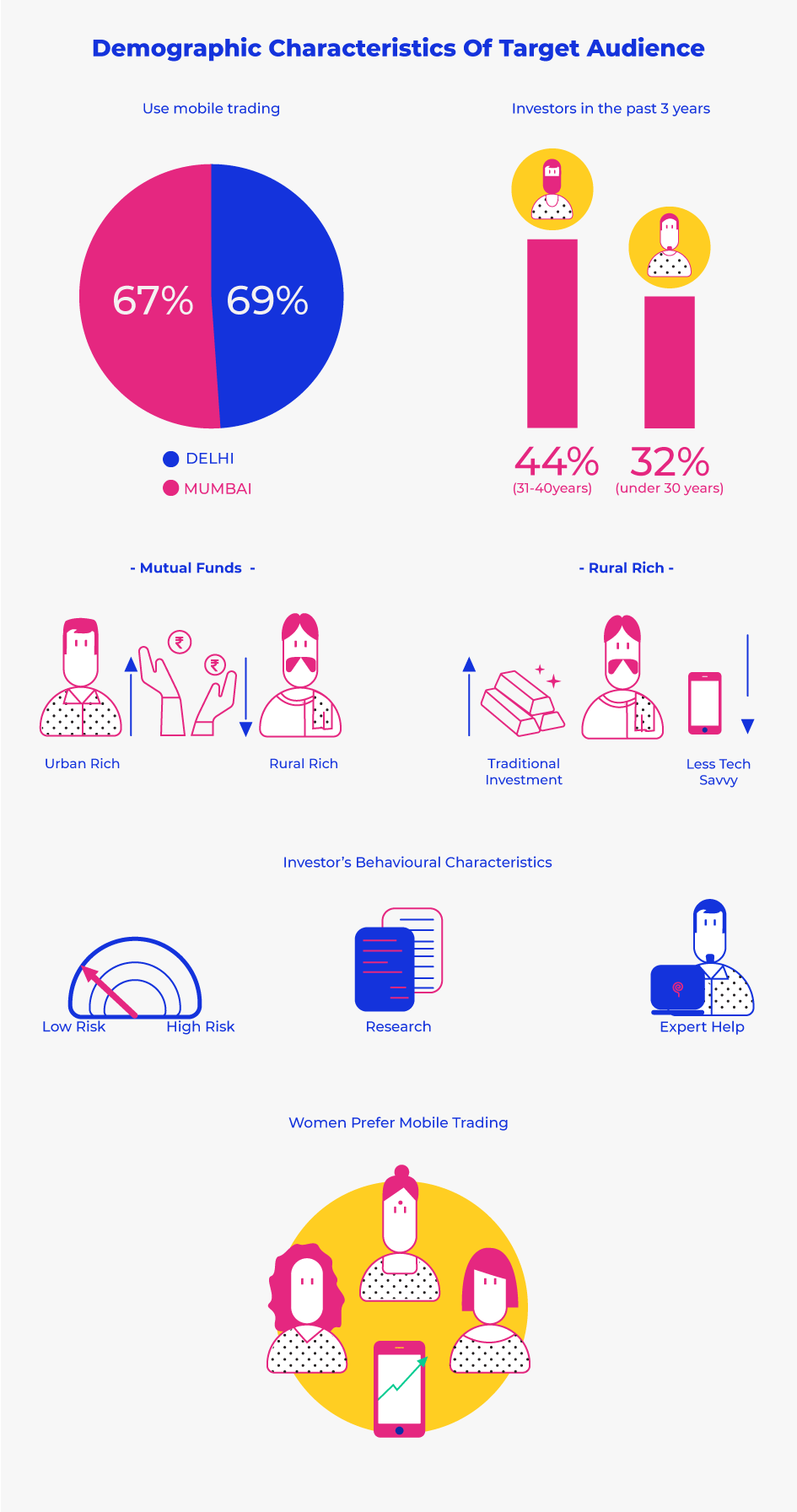

The last decade has witnessed a tectonic shift in the financial sector on account of the new emerging target audience and their investment patterns.

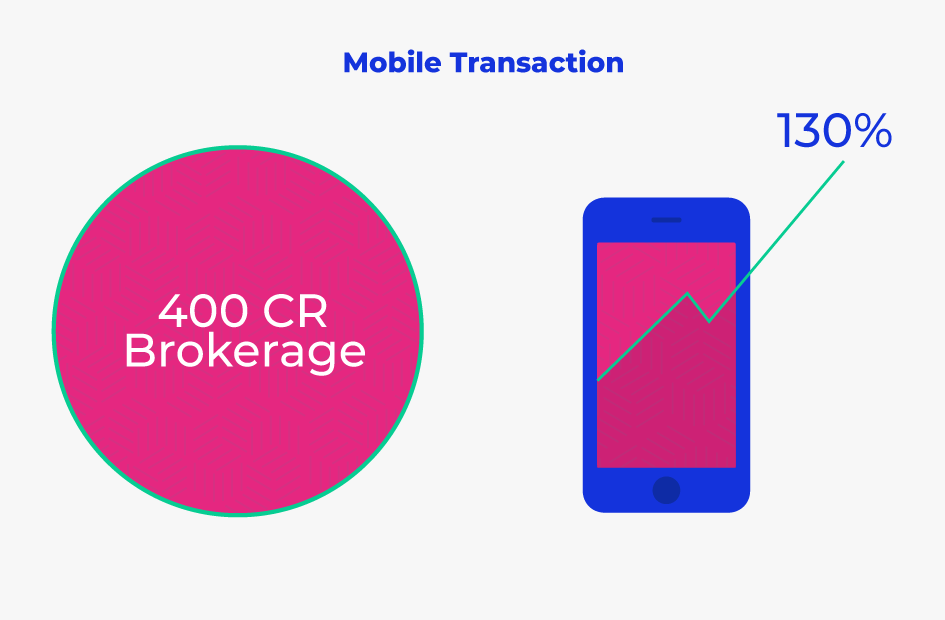

The current generation of investors is increasingly tech-savvy and this attribute is widely recognized in the online broking industry. India’s mobile-based stock trading platform, launched as recently as 2010, has become the world’s fastest growing mobile platform by volume.

Data states that the annual turnover of mobile transactions on the NSE has increased by nearly 130% over the past year. Today, the online trading industry accounts for 25-30% of retail market and fetches an annual revenue of Rs 400 crore in brokerage.

The internet boom has spearheaded the ecosystem shift in the web based stock trading platform. Let’s look at the major points that reimagined the trading game in India:

We have mapped the retail investors into four distinct persona categories based on their knowledge level about mutual funds: